If special incentives designed to lower a company’s tax burden are so important—so critical to luring business to the Idaho—why is it that only a select few certain big businesses can get them?

The state Department of Commerce recently issued a news release bragging about its Tax Reimbursement Incentive, passed the Legislature and signed into law by Gov. Butch Otter in 2014. The department breathlessly noted that the state government’s special tax incentive has resulted in 16 companies choosing to move to or expand in Idaho. It’s rare that I break the glass covering the “!” button on my computer, but here it is: !

Sixteen whole companies! How sensational!! After all, there are, thousands of businesses in the state, most of whom operate without the benefit of the “helpful” hand of state government, likely because they don’t have the lobbyists, political muscle or size to get noticed by state bureaucrats. They’re making hiring decisions every day, minus interaction from the state government.

Still, the Department of Commerce is adamant about its importance in the economic fortunes that have befallen Idaho. The department contends its lucrative tax credit is solely responsible for business expansion or hiring decisions. The reason the agency confidently so states as fact is that the department makes companies sign a document attesting that they would not have expanded or moved here if not but for Idaho’s tax incentive. To get a break of up to 30 percent against a company’s tax liability, most companies would say about anything. It’s surprising that the federal government doesn’t make parents sign a form attesting that they wouldn’t have had kids but not for the child tax credit they get from the IRS. Many parents would probably gleefully swear under oath in front of Lois Lerner that the only reason they were ever willing to consider propagating the species is because of a tax credit.

That’s not to say that special tax deals like the ones being enjoyed by companies across Idaho aren’t important to the companies applying for and getting the tax breaks. They are. Idaho’s income taxes have the distinction of being the highest in the intermountain region. At 7.4 percent, it’s a major impediment to companies even thinking about relocating to Idaho. What state officials should be doing is finding a way to significantly lower that tax rate so everyone can benefit. Why doesn’t that happen? Simple. The Legislature and the governor spend too much. It makes any tax relief impossible. Indeed, even Otter’s own punchline of a plan to lower the tax rate from 7.4 percent to 7.3 percent wasn’t even introduced last legislative session because of the rampant spending.

While the Department of Commerce is applauding its success of (supposedly) luring companies here with tax breaks for the well-connected, the story that isn’t being told is the one of companies cutting, closing or struggling mightily under Idaho’s state-run economy and confiscatory taxes.

Fortunately, state lawmakers are starting to see government-run economies aren’t so great. In the 2015 legislative session, the state Senate rejected an Otter administration bill to dispense more government handouts to more companies. In recent months, key state lawmakers have been huddling to come up with a broad tax cut plan that they hope to unveil for the 2016 legislative session.

That means they’re starting to get it: What Idaho needs is real, tangible, meaningful tax relief, a plan that gets our state tax income taxes down low, and not just for the politically connected. The impact would go to more than just 16 lucky businesses, and that would be worth breaking out the exclamation points.

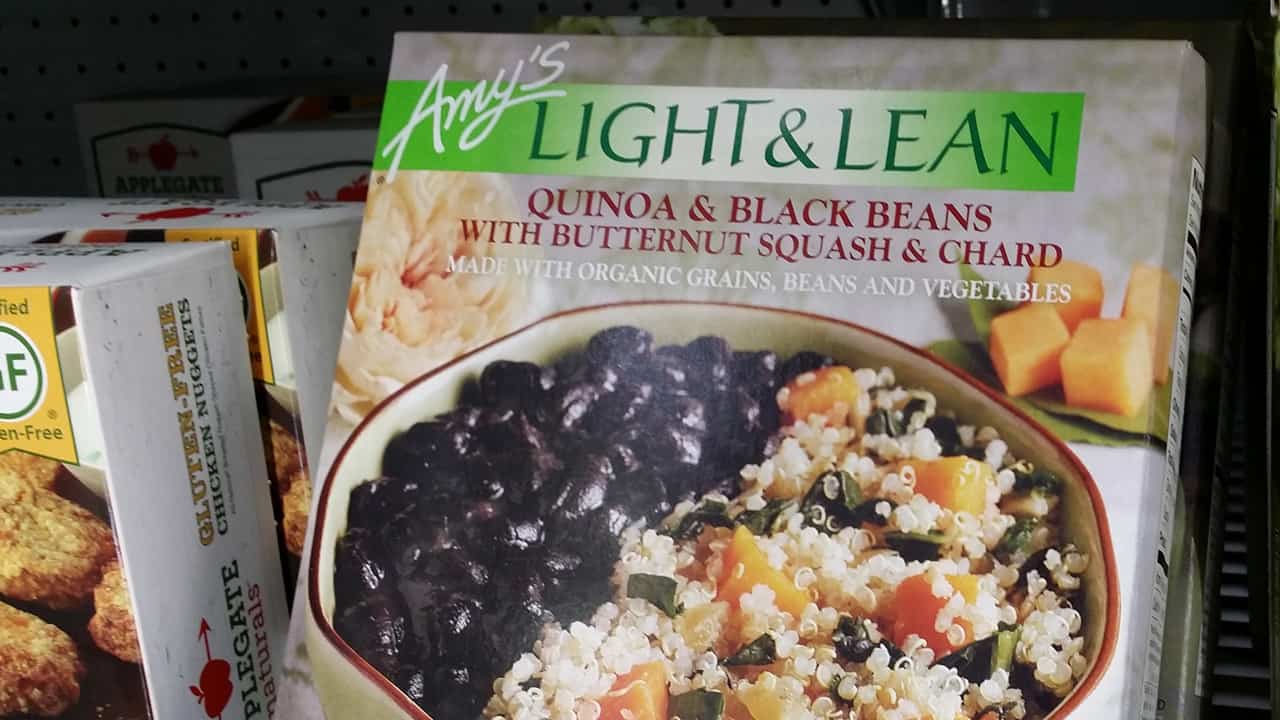

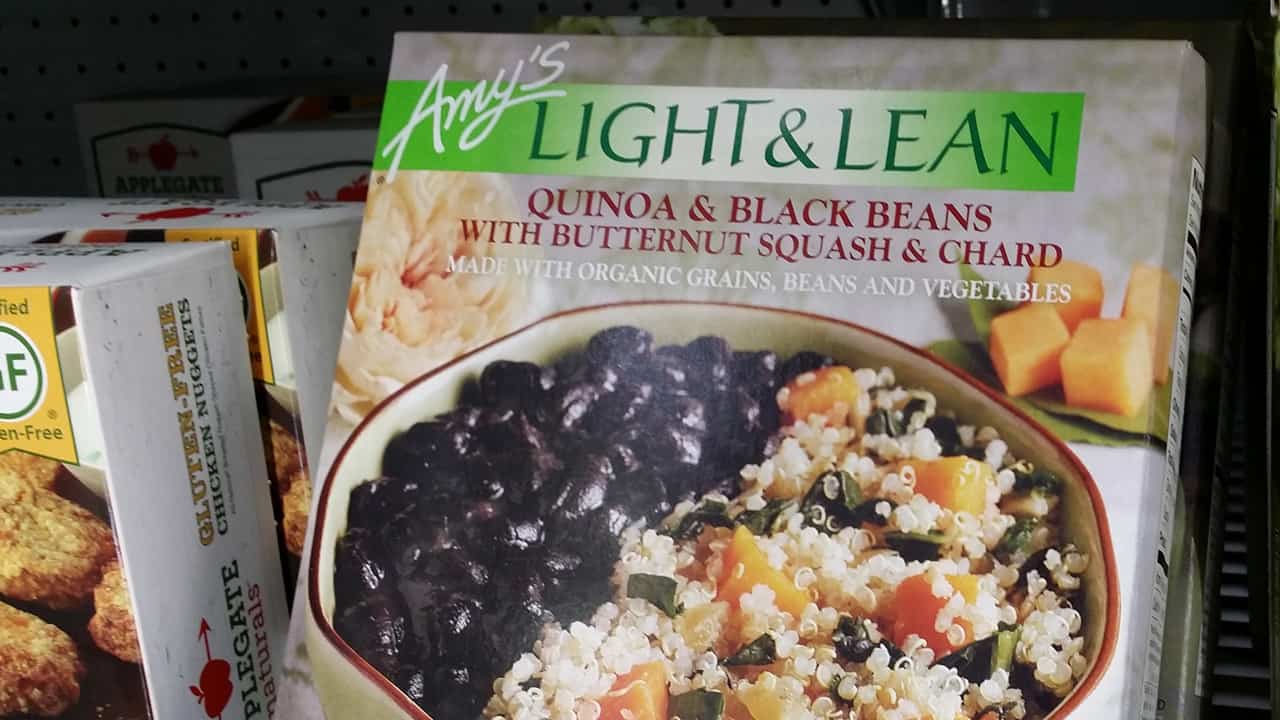

Note: Amy's Kitchen, which offers products in Idaho stores, received a tax break from the Idaho Department of Commerce.