Governor Little is no expert on gold or monetary economics. On April 8th, just before the Legislature adjourned, the governor announced his veto of Senate Bill 1314. This bill would have allowed the Treasurer of the State of Idaho to invest small amounts of idle state money (cash) in physical gold and silver instead of solely in short-term debt instruments.

The bill limited the total amount of the investment to 7.5% of the total idle monies in the state’s possession. It would have provided several options for storing the gold, including a secure depository or a chartered commercial bank or credit union in Idaho. Furthermore, the bill would have required the gold or silver storage to be audited, insured, and segregated from other assets.

The Governor’s reasons in his veto letter, as quoted in full below, were preposterous:

"While the Legislature sought to provide additional flexibility for the state's investment portfolio, we have a fiduciary responsibility to manage taxpayer dollars with the utmost care and caution. This legislation and its fiscal note fail to take into account the many additional costs that will be borne by taxpayers for the storage, safeguard, and purchase of commodities such as gold or silver."

Let’s start with his complaint about the fiscal note. Gold and silver storage comes at a cost, true, but the bill doesn’t require the State Treasurer to acquire and store gold or silver. It merely allows for the acquisition of this asset class. Any storage costs would have to be weighed against the current alternatives for idle monies, which include bonds, treasury bills, interest-bearing notes, general obligations or revenue bonds of the state, and other similar classes of paper assets. And because the bill allowed the Treasurer optionality for gold storage, a cost estimate wasn’t feasible because it would be subject to negotiation.

Governor Little must assume our Treasurer can’t compare the risk-return of one asset class to another. There may be storage costs with gold, but there are inflationary risks with bonds and treasury bills, especially in the last three years. A lot of bond funds lost value when inflation caused the U.S. Federal Reserve to dramatically raise interest rates.

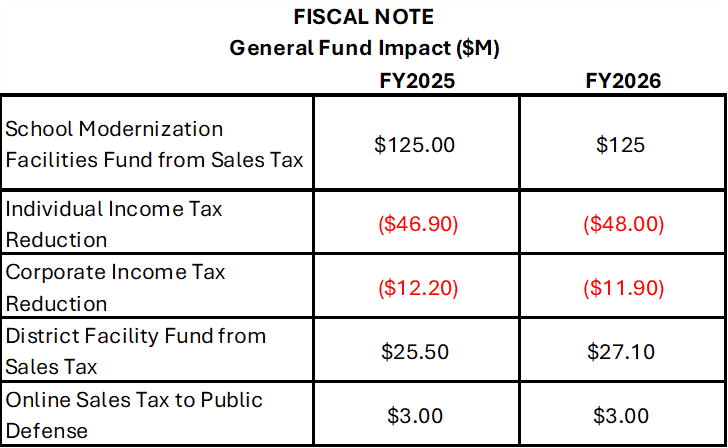

But we have another bone to pick with the governor on this. He willingly signs other bills where the fiscal notes are just plain wrong. Below is the fiscal note from House Bill 521, which used state funds to pay for school facilities coupled with a modest income tax cut.

The text box from the fiscal note shows that the transfer of funds from sales taxes to schools and public defense will have a positive impact to the General Fund when the opposite is obviously true. It shows increases where decreases are the reality. This didn’t seem to bother the governor.

And the governor signed House Bill 406, which imposed mandatory minimum sentences for fentanyl trafficking. The bill was promoted as having the impact of incarcerating more traffickers. This bill had overwhelming support, but regardless of that fact, the fiscal note assumes that additional incarceration will come at no cost. From the fiscal note, “This legislation causes no additional expenditure of funds at the state or local level of government nor does it cause an increase or decrease in revenue for state or local government therefore the legislation has no fiscal impact.”

The overarching point here is that many fiscal notes don’t merely underestimate costs; they are flat-out wrong.

So, the governor should have provided better reasons for vetoing this bill. Perhaps he didn’t because there are better reasons he could have mentioned when signing it. He could have said:

We believe that the next several years will vindicate those who supported the bill and not the governor as the fiscal disaster emanating from D.C. continues to harm those who put all their faith in federal government paper. Unfortunately, it will be the taxpayer who bears this cost.