One of the favorite phrases of conservative budget hawks in the Idaho Legislature is “starve the beast.” What they mean is that if you want to control or even reverse outrageous government growth, then you need to stop appropriating (spending) so much money. Government agencies will always find a way to spend more money once the Legislature feeds their accounts (with your tax dollars).

Problem is, except for just a couple of years since 2010, the Idaho Tax Commission has been collecting even more money from Idahoans than state analysts projected. The Tax Commission didn’t do anything wrong, but applying the tax laws as they existed during a period of strong economic growth meant more-than-expected income taxes, sales taxes, and — at the local level — property taxes.

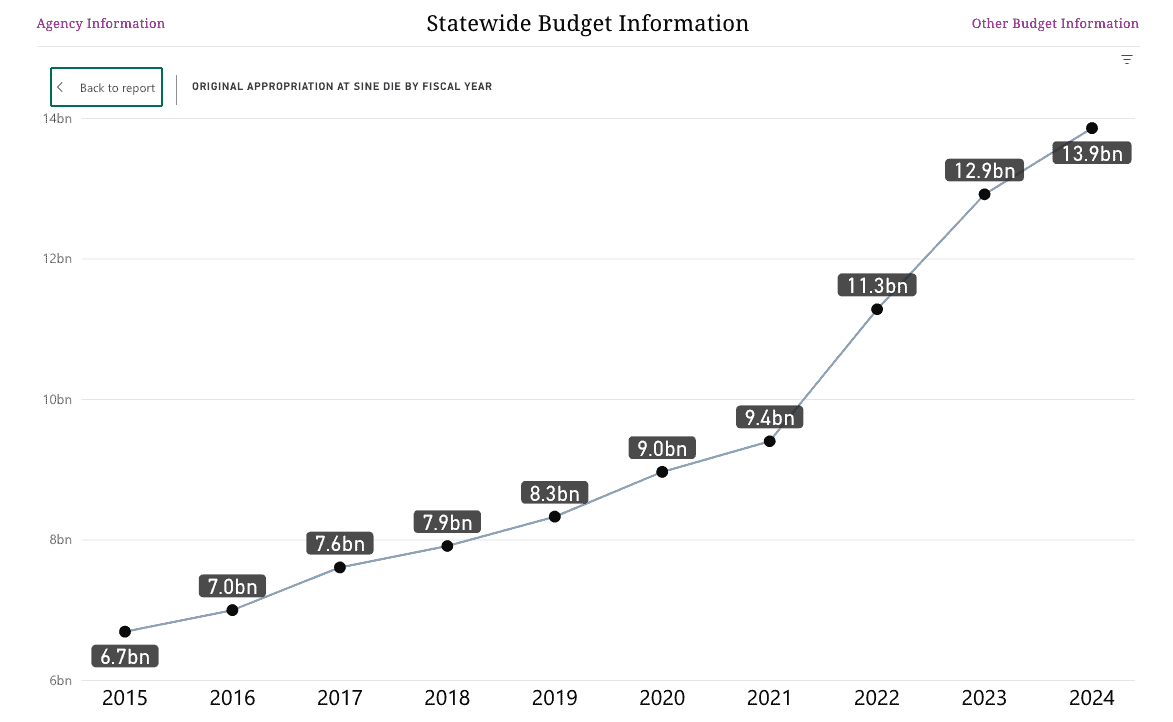

The money kept flowing in, and the government kept upping the spending. That was the story of the past decade or more in Idaho. Even before the flood of new federal (COVID) spending came gushing into Idaho, the tax collections consistently outdid state analysts’ projections.

Looking at only the Idaho state government, we see it has three major categories of revenue for fueling its spending appetite: sales taxes, income taxes, and federal dollars coming into the state. There are a few smaller categories such as fees and fines, but those are not the reasons why Idaho’s budget has blown up so much. Sometimes, the Legislature transfers large chunks of money — labeled as “dedicated funds” — which disguises a lot of spending as a “reduction in revenues.” It’s very sketchy accounting, indeed.

The main point is this; three things have fueled the higher growth in Idaho government: economic prosperity (leading to higher income taxes and sales taxes), followed by federal COVID relief spending (exceeding $9.3 billion to Idaho in just over three years), and most importantly, the Legislature’s willingness to take all the extra money and spend it instead of exercising restraint. What happened to Idaho’s budget? It expanded, and then it expanded some more.

So, what would have been better? When tax dollars are flooding in beyond projections, what’s a conservative to do? The answer is simple: refund the surplus back to taxpayers and reduce tax rates so the tax collections better match the needs of a truly limited government.

But what did Idaho do? You’ve probably guessed already. The governor and Legislature did approve moderate rebates (usually around election time) and tiny income tax cuts (from 7.4% down to 5.695%), but they still expanded government well beyond what Idaho’s population growth and inflation rates would justify (63% budget growth vs. 31% population + inflation growth in the five budget years prior to 2024). It’s worth noting that our sales tax rate is still at 6%, and Idaho remains one of only four states that fully taxes groceries purchases.

In an excellent article by our Legislative Affairs Director, Fred Birnbaum, the Idaho Freedom Foundation discusses Governor Brad Little’s claim of massive tax relief by pointing out how the state budget has grown beyond necessity and how much more our taxes could have been cut if our leaders had demonstrated true fiscal restraint. Property taxes could be wiped out entirely in just a few years by slowing or reversing government spending growth and dedicating the savings to lower and eventually eliminate property tax rates.

An analogy: mighty oaks seem to grow by more than they’re fed. How is that so? Water, nutrients, and air all add to their growth, but a botanist can tell you how such large trees can come from relatively smaller inputs. Similarly, Idaho’s budget growth far outpaces what supposedly fuels it. If you look at the “natural” increases in state population and higher prices and compare those to Idaho’s budget, then you see Idaho’s government is outpacing what’s supposed to be possible in a “conservative red state.”

One positive change would be to put a cap on budget growth at the population increase plus inflation rates, so at the maximum, Idaho’s government stays proportional to what seems necessary. Truly though, to counteract previous years’ bloat, we should be reducing government spending for the near term. The government wants to grow, but we shouldn’t over-feed it with Idahoans’ hard-earned tax dollars or with the federal government’s make-believe or borrowed dollars. Starve the beast.

We have work to do if we want our government and our tax liability to match our conservative sensibilities. Idaho should be the gold standard for shrinking and limiting government. The opportunities are apparent, but do the leaders have the courage to just say “no” already? The 2025 Legislature has a unique opportunity to reclaim Idaho’s conservative bona fides, if it can capitalize on the many electoral wins by liberty candidates. It’s time to see families, not government, do some prospering.