Nose hair is offensive. A tax on property is like the nose hair of public policy. There may not be a more offensive tax – well, maybe a tax on breathable air, but let’s not give big government any ideas.

Here are the three most nose hair-ish things about the property tax:

Good news! We can remove the nose hair!

Eliminating the tax on property may be easier than you think. In fact, a couple of steps in the process are already in effect. Did you know that in the past two years, legislation was passed to ease property taxes? Both House Bill 292 in 2023 and House Bill 521 in 2024 utilized money from the state’s General Fund to reduce school district levies and provide direct tax relief to homeowners, totaling $560 million. Both bills reduced the burden on property owners by replacing some of the local taxes with state funding.

Neither of the measures required higher state sales taxes nor income taxes to accomplish the goals; instead the state utilized the natural growth in sales and income taxes. In fact, the 2024 bill included income tax reductions along with the distributions.

This is the formula for eliminating property taxes in Idaho. Take the natural growth in sales and income taxes at the state level, and allocate the money to local governments in lieu of their collecting that amount of property taxes. Within 6 to 7 years of such incremental replacements, the growth in sales taxes and income taxes will facilitate enough allocations to offset the entire amount of property taxes being paid for local government and school districts.

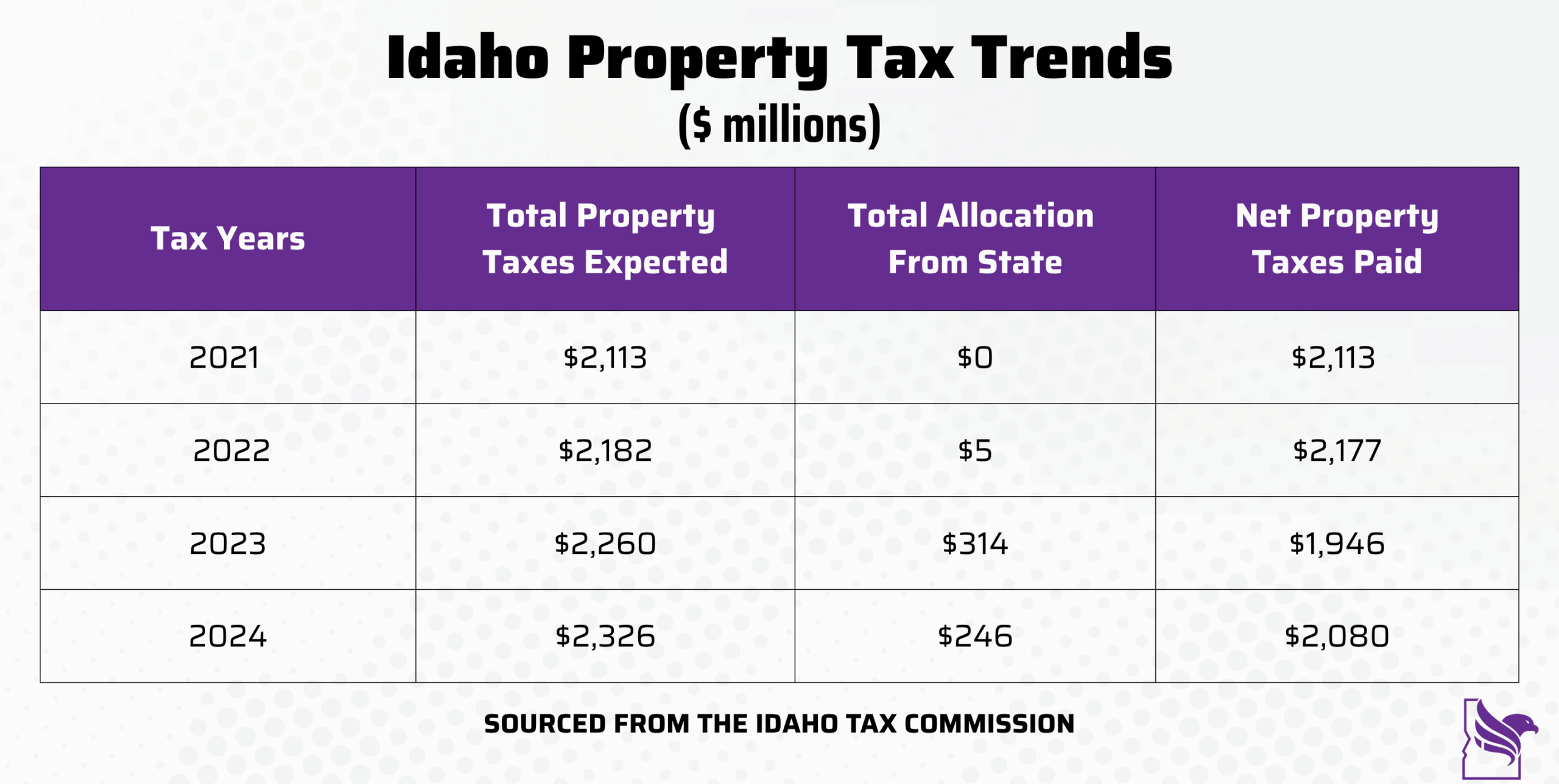

For example, here is actual data from the last few years of property taxes expected at the local level, replaced by state allocations, and the remaining taxes still collected from property owners.

Do you see how the state allocation reduced the net property tax payments by owners? Property owners paid less in property taxes in 2024 than they did in 2021. If Idaho lawmakers made even greater efforts at cementing this as the plan, perhaps $400 million per year dedicated to incremental property tax replacements, then within six years, all property taxes could be abolished.

All Idaho needs to do is continue to build on this process. Limit the growth in local government growth and spending, increase the allocations from the state to the local governments, eventually get the “Net Property Taxes Paid” to zero, and finally eliminate all property tax references in state statutes. Presto! Idaho homeowners are owners again, and Idaho has led the way to become the first state with ZERO PROPERTY TAXES!

The Idaho Freedom Foundation is leading out on this effort. With your help, we can work towards eliminating property taxes altogether.