As Idaho struggles to pass sound money policies, 13 states — including several neighbors in the west — were successful. This legislation includes defending digital asset rights, banning central bank digital currencies (CBDCs), and getting gold on the balance sheet.

While sound money became mainstream in the presidential election discourse, states are leading on these issues. Though Idaho is currently sidelined, the benefits of financial liberty in these other states show it is time for a change.

The first article in our sound money policy series demonstrated how Idaho missed several opportunities to advance these solutions in recent years. In this second piece of our series, we dive into the advancements of other states and the benefits Idaho could be missing by holding back.

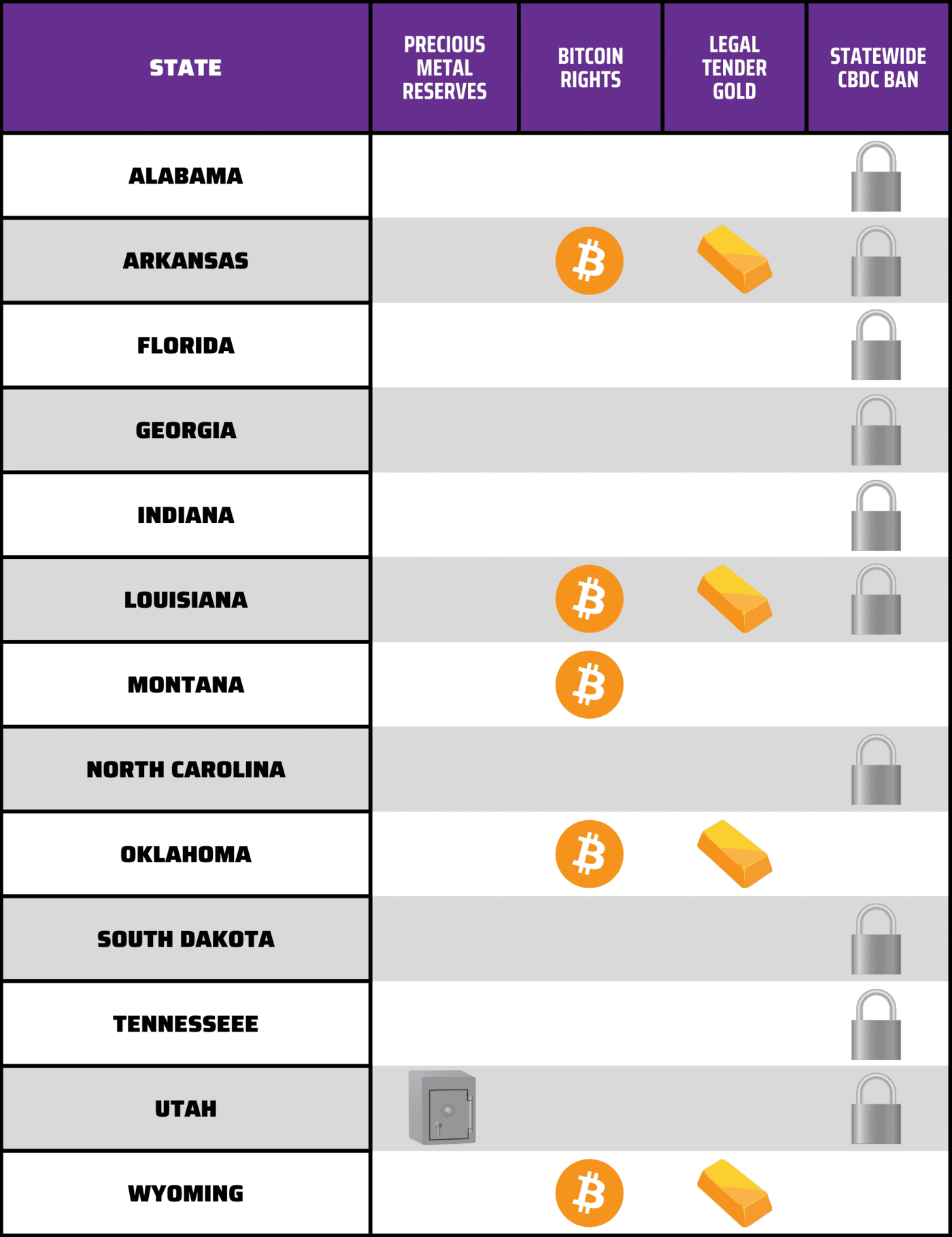

So far, advancements in sound money policy fall into four policy groups: precious metal reserves, legal tender gold and silver, digital asset rights protections, and outlawing CBDCs.

No state adopted all four policies, and only a minority of states have more than one. But we are looking at an early snapshot of these advancements. Given that virtually all these policies became law within the last two years, it is reasonable to anticipate more states will make moves as these ideas gain momentum.

So far, Idaho’s southeastern neighbor, Utah, is the only state with legislation to invest reserve funds in gold and silver. The legislation — passed this year — doesn’t explicitly provide for the physical custody of precious metal investments, but it does provide the basis for sound investment of idle taxpayer funds.

Many other states, however, took additional steps to help residents protect their savings by making gold and silver legal tender. Louisiana, Oklahoma, and Wyoming restrict legal tender to state-issued bullion and coins. But Arkansas is less restrictive, deeming all refined gold and silver stamped with its weight and purity legal tender.

In the vein of alternative forms of currency, protections for digital assets also advanced in recent years. Arkansas, Louisiana, Montana, Oklahoma, and Wyoming all protect the right to hold, mine, and transact digital currencies like bitcoin.

While some states embrace the value of private currencies, many are also waking up to the dangers of a CBDC, which is owned, operated, and monitored by the Federal Reserve. Ten states adopted provisions that define CBDCs and either refuse to recognize it as money or ban the state from participating in its use. Indiana’s law has the strongest provisions, being the only one to also ban state agencies from compelling residents to transact using a CBDC or advocating for its use.

Though these policies are relatively recent legislative developments, Idaho’s neighbors are already seeing benefits from their adoption.

Digital asset mining firms are building new data centers in Montana. Not only does this bring both revenue and jobs, but also could offer stability for a power grid strained by harsh weather conditions.

States like Wyoming continue to see expansion of digital asset mining, despite being a hub of the industry for some time.

Beyond the business of digital assets, their use in everyday transactions and savings offer privacy, stability, and access that is either threatened or impossible to achieve in the current banking system. Though these states don’t yet have additional protections against CBDCs, offering alternatives to the dollar empower private industry to use money without monitoring.

There are some areas for improvement, however. For example, Utah’s ban on CBDCs faces some weaknesses inherent in preempting the Federal Reserve.

Utah’s issue is the law merely states a CBDC is not money — a model borrowed from Florida. But a CBDC could circumvent this if it is interpreted as a means of exchanging money, rather than money itself. More effective models can be found in Indiana and North Carolina, where the law restricts the state’s use and participation in a CBDC.

Even these models can leave residents vulnerable unless the private sector is given the opportunity to use alternatives to the dollar to exit the system entirely — an approach employed in both Louisiana and Arkansas.

Utah’s example demonstrates how sound money policies must be adopted together, rather than a la carte, to be effective. Therefore, adoption of all these policies together should be the goal for states.

Though the Gem State lags behind other states on sound money, it isn’t too late to catch up — or even take the lead. In our final piece of this series, we will discuss how Idaho could adopt the “gold standard” for sound money policy, taking the lead in protecting residents’ privacy, savings, and financial access.

Overall, a growing number of states are asserting their sovereignty from a federal government that wields monetary policy to siphon Americans’ savings, surveil their behavior, and dictate their spending habits. Sound money solutions are no longer novel in today’s America. Idaho’s lawmakers should take notes from their peers and consider exercising the same protections for their constituents.